It was strangely reminiscent of that military coup where the signal to attack was, of all things, the Portuguese entry in the Eurovision Song Contest. With coded announcements, the President snatched away from a diplomatic mission, an emergency all-night sitting of the house, and plenty apparently deliberate misinformation, “Project Red” saw Ireland taken over – though not by the military.

If you went by the news coverage, you might be forgiven (a special offer, today only) for thinking that we just escaped the jaws of disaster here. On the contrary – Ireland avoided an acute short-term problem by making an awful long-term commitment. A very, very, very long-term commitment. We were forced into it at what might be termed fiscal gunpoint.

On September 30th 2008 in the wake of the collapse of Lehman brothers in the US, the Irish government pledged to guarantee the banking industry here. Not just the banks’ deposits but all their liabilities – including the vast amounts they’d borrowed from banks overseas to fuel the country’s property speculation bubble. That figure turned out to be truly mind-boggling – over €400 billion. That is more, even after inflation, then all of Germany was forced to pay in reparations after World War I.

You might fairly ask how the government of a small country could hope to come up with €400 billion. They couldn’t of course. It was a bluff, a confident front designed to ward off market chaos and speculation. But if you’re bluffing, you don’t bet the house. The government exposed the country to a liability that beggared belief. Indeed, beggared the lot of us.

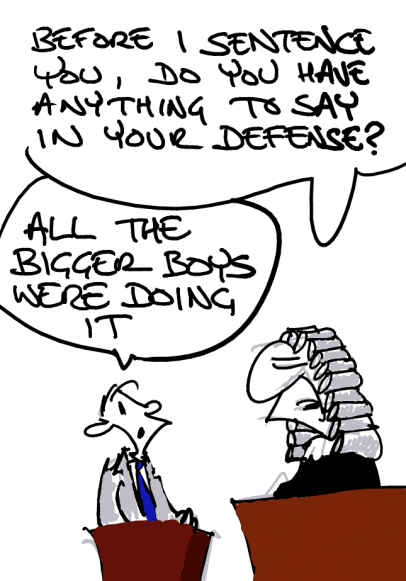

It’s been argued in their defence that the industry lied to them, directly, about the scale of their liabilities. That’s true, but they knew damn well that there was something seriously wrong anyway. These banks had been making staggering profits for a decade mainly by lending people money on excessively easy terms, thereby boosting the price of housing, thereby creating demand for bigger loans… Banks had been enjoying a prolonged bonanza, but it was a bonanza of debt raised against assets that no one could seriously argue were not grossly overpriced.

Why had banks not simply raised the price of borrowing, to profit more from less lending – and at the same time moderate demand? Because there was no limit to the amount of money they had to offer. Other banks, in the US, the UK, but mainly in continental Europe, were lending them as much as they could shift. There was a global credit boom going on of course, there was an (originally) quite genuine boom in the Irish economy, and to cap all this there was no longer a national currency to wildly inflate and so damp things down as had happened in booms gone by. Ireland represents perhaps 1% of the Eurozone economy, so even incandescent levels of overheating here were not going to drive up the cost of money. Money was, as odd as this may sound, too cheap. Yet keeping inflation down was the main – indeed about the only – guiding principle of the European Central bank. It, or rather its political masters, chose to pursue a policy which might have been reasonable for the Eurozone as a whole, but which was utterly unsustainable for Ireland.

Some people, mainly politicians eager to share out their responsibility, have blamed the population for borrowing too much, as if economic meltdown is caused by sudden outbreaks of cupidity. Those who borrowed more than they should have did so in the main because banks were quite literally pushing money on them. Like many, I opened my post one morning to find I’d been approved for a loan I hadn’t asked for. Certainly far too many got into property, but the housing boom was not only driven by speculation. Another major factor was that thanks to all this cheap credit, house prices were rising far faster than incomes. People worried – not unreasonably – that if they didn’t buy a house soon they would never be able to afford one. Lenders fuelled the fear with the marketing image of the “property ladder”, the idea that if you wanted any chance of owning a good home in the future you needed to buy a bad one now. Many, many awful houses and apartments were sold – and even more built. The entire Irish banking industry had in effect become a Ponzi scheme, profitable only as long as there was new investment. When the market fell it fell like a lift with the cables cut. In doing so, it called the government’s bluff.

At which point they could and should have said “You got us. Of course we can’t possibly afford to pay that much money. Ever. It’s an insane figure.” And they would have been right of course, we can’t. Even after realising the assets of the collapsed banks and throwing in the national reserves, we’re still left something like 70 billion short. They even had an excellent excuse to renege on the guarantee when it came to light just how much these banks had been lying to them about their assets. They should have known better, sure, but officially they didn’t.

Unfortunately however government needed to pay more than just the billions in bank debt. This Ponzi scheme had essentially become the tax base. Not only was a lot of revenue raised on property sales, a simply ludicrous proportion of the population was by then employed in building buildings that no one would ever actually want but which existed solely to be traded on the bubble market. Without this income the exchequer couldn’t even keep public services going, pay doctors and teachers and police and pensions. But the fact that our economy looked to be (and indeed, was) on the point of collapse meant that the country couldn’t borrow cash on the market at anything approaching an affordable rate. The only institutions with both the money and the motivation to lend to us affordably were those of the Eurozone, the very ones who were to a large degree responsible for the collapse. In return, they held us to the untenable: The undertaking to pay back all the money our failed banks had borrowed to fuel the property bubble. The fear being that if we didn’t, the banks that lent to our failed banks would in turn fail, and so on.

So the Irish government’s gamble didn’t save our banking industry; virtually ever lending institution in the country (honourable exception: the Credit Union movement) went bust. But it probably stopped the European banking system going down like the world’s most expensive set of dominoes.

This is what really rankles. Instead of being punished by the market for poor – indeed, reckless and harmful – investment decisions, these institutions are going to be rewarded just as if they had made profitable decisions. They’ll probably give themselves bonuses. And these rewards will be paid not willingly by the market but unwillingly by the taxpayers of Ireland whose jobs and lives they so damaged. And the taxpayers’ children. And their children, if there’s anyone left here by then. Those of us who had the willpower to resist the easy credit have to reward them, just as if we’d taken it. Those who lost their homes because they could not afford the repayments to these institutions, still have to reward these institutions. Those who now own homes worth a fraction of what they owe on them but who are nevertheless still making repayments to these institutions, will see their taxes go to these institutions. The injustice of it is barely conceivable. Ireland is paying roughly 42% of the cost of Europe’s banking crisis. We can’t possibly do it of course. That’s why the Eurozone governments and ECB cut the deal that all the fuss has been about. To help us.

To help us pay back the money we didn’t borrow.

You may have seen the headline figure, that this is meant to save us €20 billion. Are they writing off some of the debt? No. On no account are we to even contemplate not paying any of that money. The twenty billion is just the difference between the “easy” interest we’ll get from them and a rate we might have paid otherwise. They’re giving us easy terms to repay the debt we don’t owe. Some deal.

This explains why we had to shut down the Irish Bank Resolution Corporation – formerly Anglo – literally overnight. While most of the bad debts of the various failed Irish institutions were still being held by this “zombie bank”, there lingered some remote possibility that a government would have the guts to say “Look, the state has no moral duty to pay back failed private investments. Goodnight.” We almost certainly would have negotiated a deal rather than just pulled the plug of course, but we had that bargaining chip. Instead we’ve cashed in our last chance for freedom. Whereas repudiating Anglo’s debts would not have been technically or morally a loan default – indeed, might have been seen favourably by the markets as the shedding of a liability – there is no way out of our commitment to the ECB. Short, that is, of crashing out of the Euro in flames.

So now we are committed to this vast payment. That still doesn’t mean we can pay it of course; indeed, attempting to will just drive us deeper into recession. We will inevitably default on this, as Germany defaulted on the onerous Versailles treaty terms. It will just be later rather than sooner. The only achievement will be a few more years – perhaps decades – spent impoverishing ourselves to enrich those irresponsible lenders.

The “deal” won yesterday was quite the opposite – a scared and desperate government buying time and in doing so, condemning their country to indefinite economic servitude. Death of the Republic would hardly be an exaggeration. Democracy is effectively suspended; the government we elected to overturn the errors of the last has repeated and even amplified them. We are being dictated to – not by the military, not by a despot, but by an industry.

So the “Anglo Tapes” – internal phone recordings made during the last days of

So the “Anglo Tapes” – internal phone recordings made during the last days of